How Much Should An HOA Have In Reserves?

Introduction

Deciding on the right amount for an HOA to hold in reserve funds can be tricky. Many boards struggle with finding that sweet spot—too little and they risk not covering future expenses, too much and they may overburden homeowners with fees.

A key fact to remember is that experts suggest a reserve fund should be at least 70% funded based on the property’s calculated deterioration. This blog will break down what reserves are, why they're important, and how you can determine the perfect amount for your HOA.

We'll offer best practices, touch on regular reserve studies, and share insights to manage those funds effectively. Ready to learn more? Keep reading.

Understanding HOA Reserve Funds

What Are HOA Reserve Funds?

HOA reserve funds are like a savings account for homeowners associations. These funds cover future repairs and replacements in the community, such as fixing roofs or updating pools.

The goal is to avoid special assessments by saving ahead of time.

A healthy HOA reserve fund ensures that communities can handle big projects without financial stress.

Associations should conduct regular studies to figure out how much money they need in these reserves. Experts suggest keeping the fund 70% funded at least, aiming for 100% to be safe.

This way, an HOA stays ready for any project or emergency without extra costs to homeowners.

The Importance of HOA Reserve Funds

Transitioning from understanding what HOA reserve funds are, it’s crucial to grasp their significance. These funds ensure an association can cover future expenses without financial strain.

A well-funded reserve minimizes the need for special assessments that burden homeowners unexpectedly. It shows responsible management and planning by the HOA board, reflecting positively on the community's overall health and appeal.

Reserve funds play a pivotal role in maintaining property values by ensuring there is enough money to cover necessary repairs and replacements. This foresight prevents deterioration and keeps the community attractive to current and potential residents.

An adequately funded reserve—ideally at 100%—allows for smooth operations, avoiding disruptions that could arise from inadequate funding.

How Much Should an HOA Keep in Reserve Funds?

Managing HOA reserve funds effectively requires strategy and foresight. Keeping a separate account for reserves, while also assessing these funds regularly, guides an HOA towards financial health.

Separate Accounts for Reserve Funds

Keeping reserve funds in a separate account is crucial. This setup allows the HOA to clearly track and manage the money set aside for future repairs, replacements, and emergencies.

It's all about ensuring financial stability. A clear division between operating funds and reserve funds prevents mixing of daily expenses with long-term savings.

HOAs should consult with a management company or financial advisor to open the right type of account for these reserves. This step helps in maximizing interest on saved money while keeping it accessible when needed.

Making smart choices now prepares the community for any unexpected costs down the road without straining the regular budget.

Regular Assessment of Reserve Funds

Reserve funds play a crucial role in the financial stability of an HOA. Regular assessment ensures that the reserve fund is adequate to meet future needs. Here's how HOAs can effectively assess their reserve funds:

- Conduct a Reserve Study Annually – This study identifies current and future repair or replacement costs for common area elements, helping to predict how much money should be in the reserve.

- Update Financial Plans – Use results from the reserve study to adjust yearly budgets, ensuring enough money is allocated for anticipated expenses.

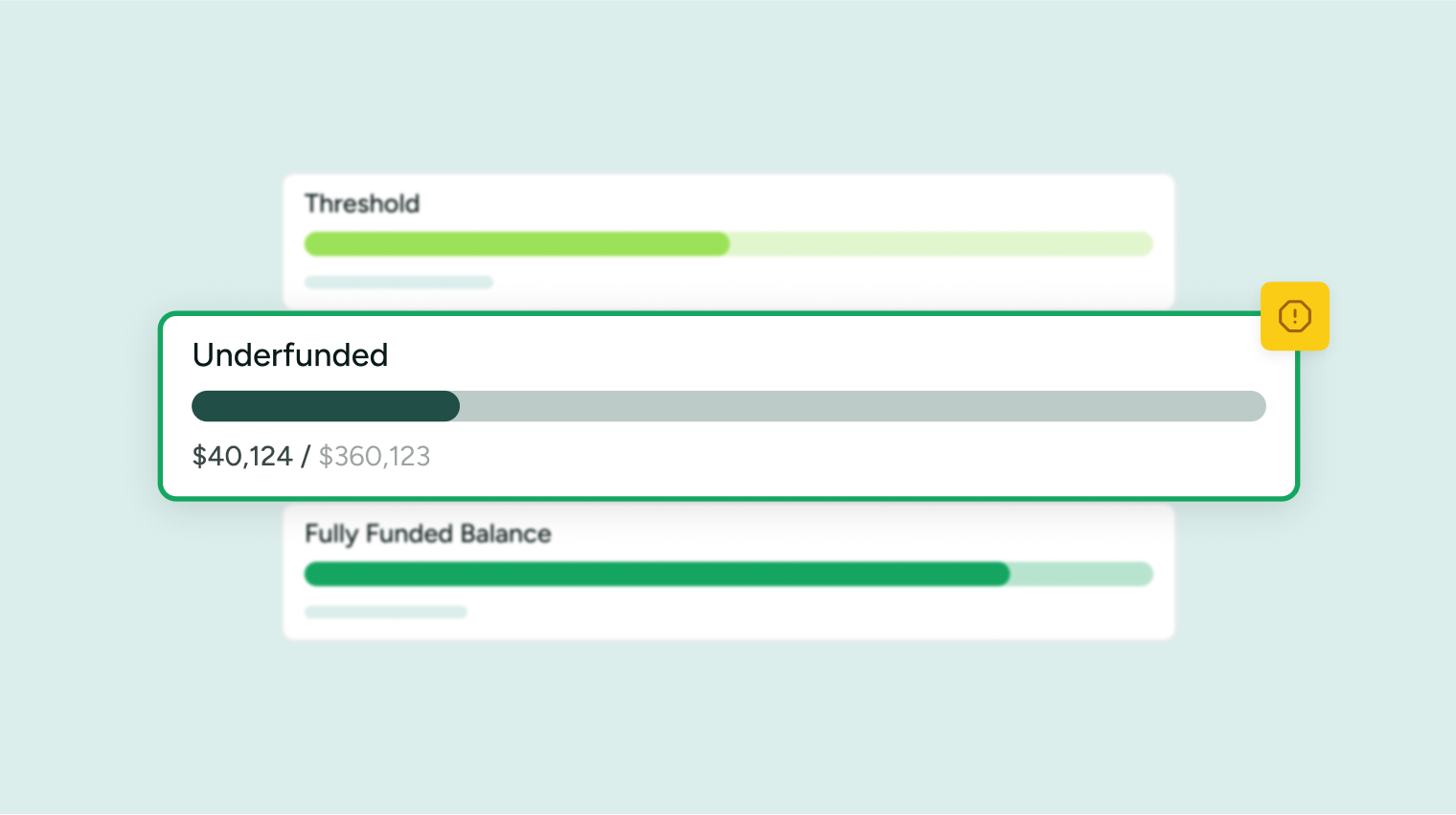

- Evaluate Fund Health – Check if your reserve fund sits within the 70-100 percent funded range, as this is considered healthy and adequate.

- Assess Risk Management – Determine if your current fund level prepares you for unexpected costs or repairs, reducing financial strain on the HOA.

- Review Investment Strategies – Safely investing part of the reserve funds can help grow the balance, but it requires careful management to avoid unnecessary risks.

- Engage with Professionals – Consulting with financial advisors or a reputable HOA management company can provide insights into optimal fund levels and investment opportunities.

- Educate Board Members – Ensure all board members understand their roles in managing and assessing the reserve fund, promoting informed decision-making.

- Communicate with Residents – Transparency about how funds are used and managed builds trust; keep residents informed through meetings or newsletters.

- Plan for Long-Term Goals – Look beyond immediate needs; plan funding for long-term projects to ensure continuous community improvement without financial hardship.

- Adjust According to Legislation – Stay updated on any legal requirements regarding minimum reserve fund levels to ensure compliance and avoid penalties.

This approach ensures that an HOA’s reserves are not only sufficient but also responsibly managed, prepared for both expected costs and unforeseen challenges alike.

Conclusion

Keeping HOA reserves healthy is a must. Aim for the sweet spot—between 70 and 100 percent funded—to cover all future expenses confidently. Regular reserve studies ensure this goal isn't just wishful thinking, but a practical plan in action.

With board members vigilant about funding, HOAs can navigate financial waters smoothly, prepared for whatever comes their way. A well-managed reserve fund equals peace of mind for everyone involved.

FAQ

Take Control of Your Association’s Future